Mastering Tax Preparation: Tips for Colorado Residents

Introduction

Navigating the complexities of tax preparation can be daunting for Colorado residents. With state-specific regulations and potential changes in tax laws, it is crucial to stay informed and organized. Leveraging expert assistance such as Denver Tax Services can alleviate stress and ensure accurate filing. This article provides valuable tips to help you master tax preparation in Colorado.

Understand Colorado Tax Laws

Before diving into tax preparation, it’s essential to familiarize yourself with Colorado’s tax laws. The state imposes a flat income tax rate, which simplifies calculations but requires awareness of deductions and credits unique to Colorado. Staying updated on any legislative changes can also prevent errors. Engaging with Denver Tax Services can provide insights into these nuances and help you optimize your tax situation.

Organize Financial Documents

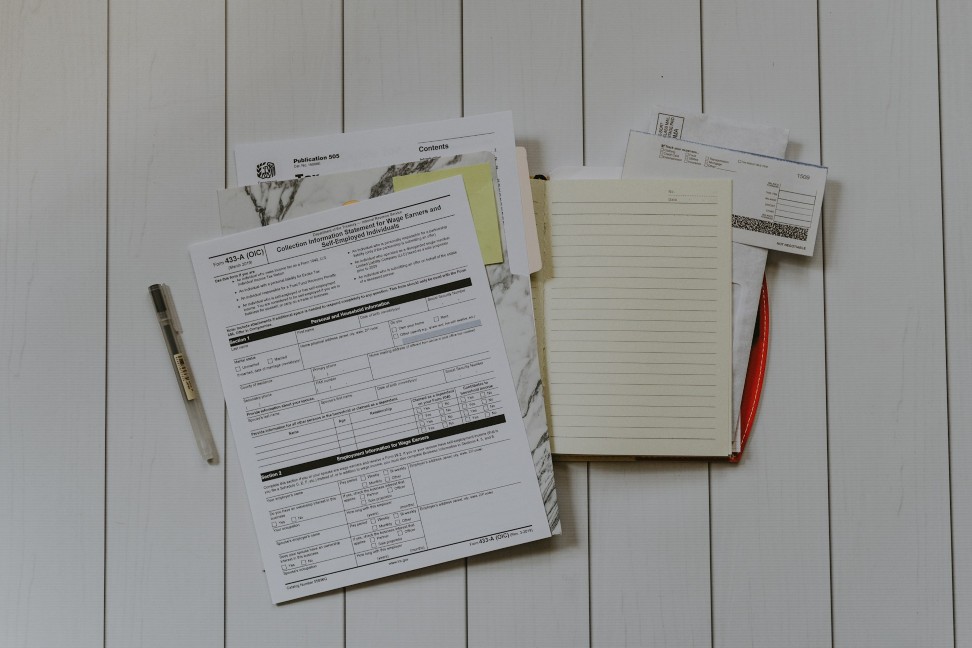

Effective tax preparation begins with organized financial documents. Ensure you have all necessary forms, such as W-2s, 1099s, and receipts for deductions. Create a comprehensive checklist to track what you need. This organization not only speeds up the filing process but also reduces the likelihood of missing crucial information. Denver Tax Services can offer guidance on which documents are necessary for your specific circumstances, ensuring nothing is overlooked.

Maximize Deductions and Credits

Colorado residents should take full advantage of available deductions and credits. Whether it’s the Child Care Contribution Credit, the Innovative Motor Vehicle Credit, or charitable contributions, these can significantly reduce your tax liability. Understanding eligibility criteria and maintaining proper documentation is vital. Consulting with Denver Tax Services can help identify applicable deductions and credits, maximizing your potential refund.

Consider Professional Assistance

While some individuals prefer a DIY approach to tax preparation, seeking professional assistance can be beneficial, especially for those with complex financial situations. Denver Tax Services offers expertise in navigating the intricacies of state and federal tax codes, ensuring an accurate and timely filing. Professionals can also provide strategic advice for future tax planning, helping you make informed financial decisions throughout the year.

Conclusion

Mastering tax preparation involves a combination of understanding state-specific laws, staying organized, and leveraging available deductions and credits. For Colorado residents, especially those in the Denver area, partnering with experts like Denver Tax Services can streamline the process and enhance your financial well-being. As tax season approaches, consider these tips to ensure a stress-free and successful filing experience. By taking proactive steps and seeking professional guidance, you can confidently navigate your tax obligations and secure your financial future.

To learn more, visit us on:

V Tax Professionals Ltd.

https://www.vtaxservices.com/

9703068221

26 W Dry Creek Cir, Suite 616, Littleton, Colorado, 80120

V Tax Professional Ltd is your trusted partner for comprehensive tax services in Denver metropolitan area, Colorado. With a proven track record of excellence, we specialize in tax preparation, resolution, and planning, ensuring that you navigate the complexities of the tax landscape with confidence and ease. Our team of experienced tax professionals is dedicated to providing personalized solutions that cater to your unique financial needs.

Dealing with tax issues can be overwhelming, but you don’t have to face them alone. Our seasoned professionals specialize in tax resolution, helping you tackle problems such as back taxes, IRS collection issues, and IRS penalties.

Our commitment to precision and attention to detail sets us apart!